Why we should worry about TescoTuesday 23 September, 2014

Business is boring. It's run by middle-aged white men in suits who think only of money. Business news is boring. It's written in a strange language full of initials and acronyms and league-rankings that is deliberately unappetising to keep outsiders beyond the fence. Like sport? Well, yes. Except sport is interesting, it's soap opera. People talk about it down the pub. People don't talk about takeovers and hedge funds and derivatives down the pub. We're all experts on rugby during the World Cup, cricket during the Ashes, and, this week, on golf for the Ryder Cup. But we don't want to rap over phosphate prices or supply chains - until we have to pay more for our groceries. This mentality is not confined to the pub. It can be seen on newsdesks and back benches every day - which some might say shows how much they are in tune with public thinking. They swoop when a good story breaks off their usual patch (ie, when the much-hated BBC starts reporting it) and demand that experts from the outer reaches of sport or biz provide copy. The men (for it is overwhelmingly men) who run and write for the business and sport sections hate it when this happens. This is for a number of reasons:

News editors hate it too. For a number of different reasons:

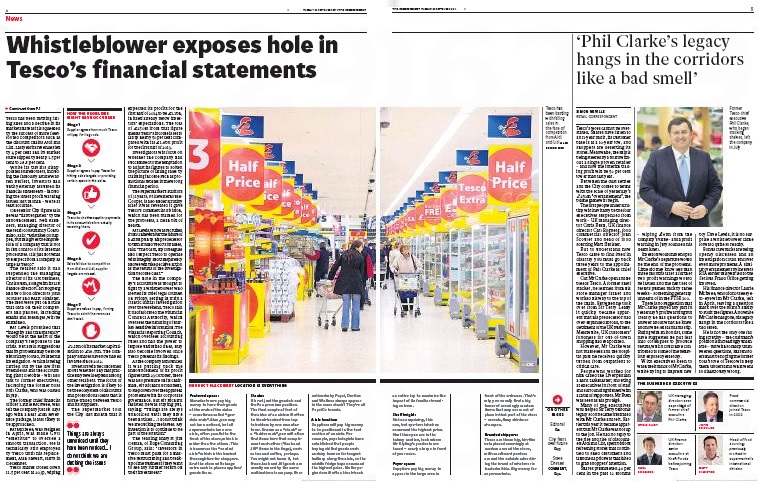

SubScribe knows this to be true, having employed every one of those eight arguments at one time or another. These negotiations are conducted in an atmosphere of friendly deference, each side silently acknowledging its lack of understanding of the other. But the trouble is that the stories that give rise to these conversations are by their very nature the ones that have broken free of the bounds of their "home" pages and are demanding wider attention. That probably means they matter. This morning the Independent, Guardian and Daily Mail splashed on Tesco, which has admitted that its profit prediction was £250m out - that is by 25%. That is a heck of a lot of money and a huge margin of error. It is not clear yet whether this was deliberate misaccounting or incompetence, whether staff under pressure to produce improved results took to massaging the figures or whether they were unduly optimistic about future sales and started spending the lottery win before they bought the ticket. Either way, it matters. The Sun recognised as much and gave it a top single slot on its "Breaking Bad" page 1. The Telegraph and Times found no room for it on their front pages. The Times had three serious stories plus a static picture of a woman at a film premiere and puffs on spiders and friendly universities. It compensated by making Tesco the page 2 lead with extensive coverage in business. The Telegraph had six stories, including a short one based on a Radio Times interview with Alan Bennett about his television viewing habits. There was no Tesco coverage in the news section. Instead it led the business supplement, with further reports on page 3 and a commentary in the lefthand slot on page 2. The Telegraph's approach is to speculate on the future of Tesco chairman Rick Broadbent and to focus on trading aspects of the story - the supply deal, the executives under attack, the impact on other supermarket shares, a rather pointless sidebar about big "mistakes" by other corporations. Allister Heath's commentary on page 2 raises questions he says investors should ask. None of this would interest the casual general reader or enlighten anyone who seriously follows City matters. It is hard not to draw the conclusion that no one at the Telegraph had a clue about how big a story this was and is. Even the word "woes" in the page 3 heading suggests that this is a lot of fuss about something minor, an everyday accounting failure.

Compare that with the Independent, which splashes on the story - with a super heading - bolstered by a 4-5 spread that includes a plain English run-through for the lay reader and a second lead on the Phil Clarke, who was the company's chief executive from 2011 until recently. There's also very simple panel on how things may have gone wrong, another on the four suspended executives, and an excellent little sidebar on product placement.

For the business reader there is more, including a splash on the fear of further horrors down the road and even the possibility that the supermarket could become a takeover target. This turns to the next page, where the text includes a look at how the invincible Warren Buffett has caught a cold from his dalliance with Tesco (though he isn't a £112m loser as the head says - that would be the case only if he'd sold all his shares today). The package is completed by a commentary from Steve Dresser which, to be fair, is pretty much a repetition of the material in the news section.

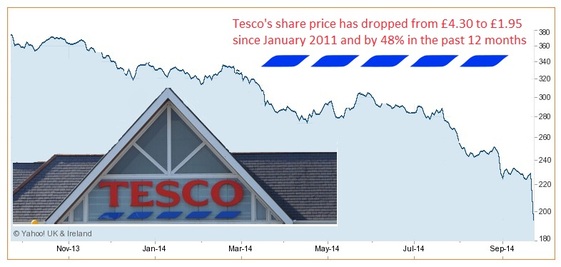

Why do we care about any of this? The hard cash reason is that it directly affects all of us, our pensions, endowments, investments, savings. Every pension fund will have a stake in Tesco. And the value of that stake has fallen by just under half in the past 12 months. At the end of 2010, when Sir Terry Leahy was still in charge, Tesco was the 15th biggest company in the FTSE-100; its shares were worth £4.30, giving it a market capitalisation of £3.4bn. By the end of last year it had dropped to 22nd in the league table, its shares were down to £3.30 and market cap had fallen to £2.7bn. Three weeks ago it was 28th, shares were £2.30 and market cap £1.9bn. Today the decline has accelerated with shares trading at £1.95, making the market cap £1.7bn, which in turn means that it has probably dropped another couple of slots in the FTSE league. That's some decline. But there's more to this than financials. Tesco has a huge influence on our society - as we can see from the "Not in our town" protests when it wants to open a store where it's not welcome. It buys land speculatively and if it doesn't feel like developing it, it leaves it to fall into dereliction. There seems to be no lawn on which it won't park its tanks: legal services, pet insurance, opticians, convenience stores - forget Tesco Express, did you know that One Stop shops were owned by Tesco? This is the free market in action; other supermarkets venture into the same areas. But what happens when one as big as Tesco comes a cropper? What happens to the communities where local businesses have been driven to the wall by the big boys if the big boy decides to pull out? Apart from sneering at provincial nimbys, newspapers tend not to write too many stories that show Tesco in a negative light. This may or may not have anything to do with the fact that the company is a reliable source of advertising revenue. It may be because people feel affection for the place where they do their weekly shop - as they did for Woolworths and still do for HMV. But there has been little news from the business over the past four years that hasn't been bad news - and maybe that very fact led some to think last night that this was just another drip from the tap. This may be a case of an old business struggling in the face of upstart competition; it may be that staff being pushed to deliver results have been driven beyond cutting corners to dodgy practices - think NHS scandals, think phone hacking - or it may be that Tesco is showing symptoms of a malaise that affects the whole sector. Whichever is the case, we need to keep our eyes on this: the story is too important to be pushed back behind the features, obits and toenail clipper ads without so much as a cross-ref brief up front. It is also too important to be brought forward to news only to be chopped to six pars to make space for another bit of Downton or Strictly. And if anyone is in any doubt about this, just remember what happened last time we thought a business was too big to fail. |

|

A second opinion

It may be an overstatement to describe Tesco as retailing's Royal Bank of Scotland. Despite everything it remains profitable, if less so than investors had at first been told. But, like that fallen giant of banking, Tesco seems to have fatally over-reached itself while adopting a profoundly dysfunctional corporate culture

- Independent leader

The British Journalism Awards

Entries are invited for the Press Gazette awards, which recognise public interest journalism that makes a difference Click here for details |

Please sign up for SubScribe updates

(no spam, no more than one every week or two)

|

|

|